With the ongoing financial uncertainty that stems from the COVID-19 pandemic, employees' retirement savings needs could fluctuate over the coming months and even years. The challenge for employers lies in their ability to deliver clear and approachable retirement planning communications that stay consistently aligned with their priorities.

Even in times of economic ease, retirement planning can be an intimidating topic. But when employees are feeling the strains and stresses of financial uncertainty, they can become so overwhelmed with financial decisions, they fail to take action at all.

For retirement planning to really resonate with employees and motivate them to act, the onus is on employers to deliver targeted communications that are appealing and accessible to the audience, easy-to-understand, and personalized to reinforce empathy and ease.

Planning for the Future Despite Financial Uncertainty

Many employees have taken financial steps backward because of COVID-19. According to Fidelity’s 2021 Financial Resolutions Study, more than two-thirds of U.S. adults surveyed in October 2020 experienced financial setbacks as a result of the pandemic, citing furloughs and reduced work hours as a few of the reasons why their financial situation was worse than it was the previous year.

Employers can help frame the message that small, manageable steps in the present can still have a substantial impact on their financial future. Encouraging them to increase their contribution rates by as little as 1 percent could amount to a considerable increase in their retirement savings in 10 or 20 years.

Effectively Communicating Retirement Benefits

Effective retirement plan communications should be easy for employees to access and understand, but it’s still possible for them to misinterpret terms frequently used by financial providers, HR specialists and the retirement planning industry as a whole. A 2019 study conducted by the Empower Institute discovered a majority of employees are confused about some of the “standard” retirement industry jargon. A few examples:

- 66% of respondents didn’t understand what the term “rebalancing investments” means.

- 69% of respondents were unclear about the meaning of “asset allocation.”

- 76% of respondents (and 88% of Millennial respondents) didn’t know what a “defined contribution retirement plan” is.

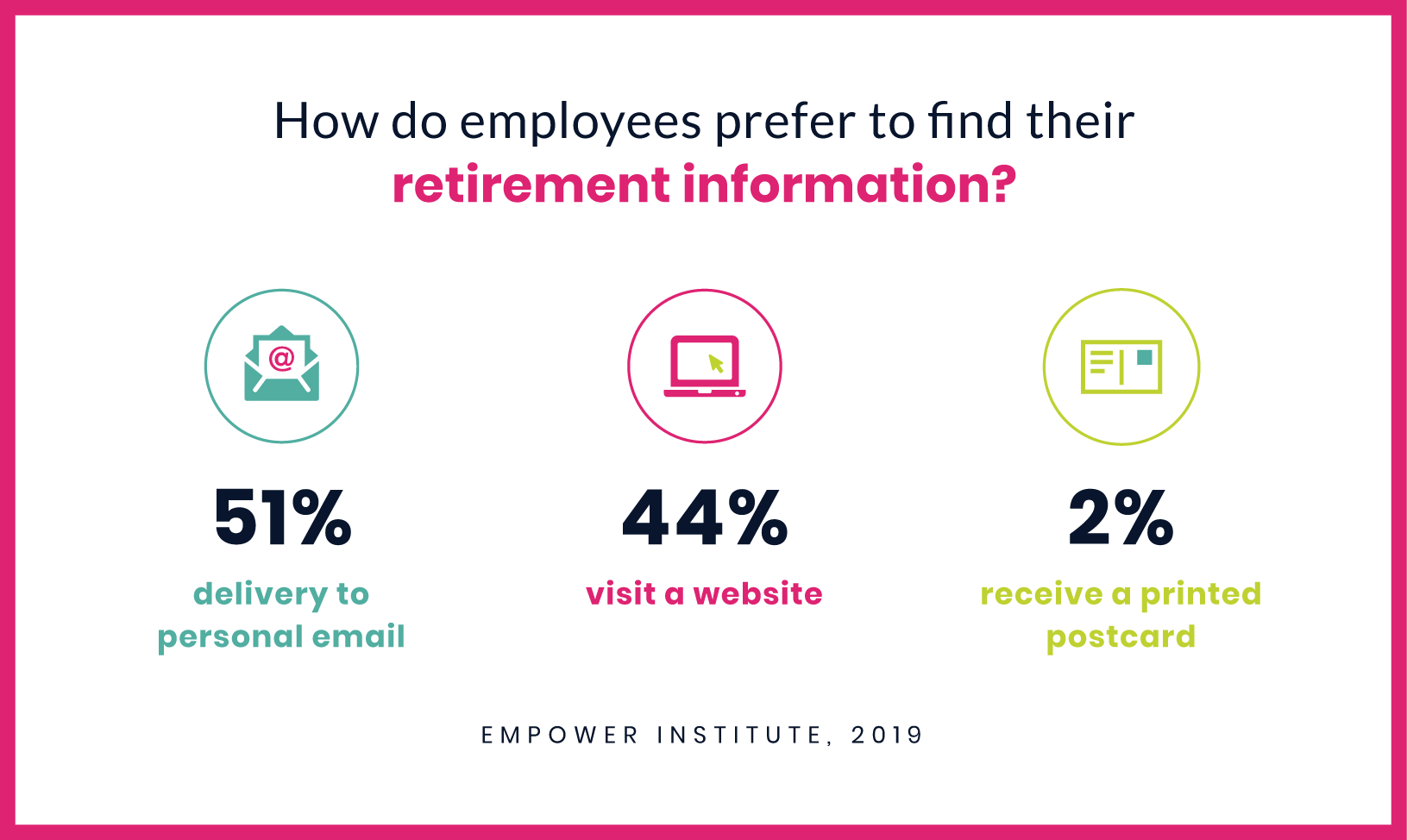

The same study showed:

- 51% of respondents preferred for their retirement planning information to be delivered to their personal email.

- 44% preferred to visit a website for their retirement planning information.

- Only 2% of respondents preferred printed postcards ‒ making them the least chosen source for retirement benefits information.

When it comes to effectively communicating retirement benefits, the above data demonstrates that 1) today’s employees require a deeper education about their retirement benefits, the terms being used, how the industry refers to key information, and 2) they prefer to receive that information either via email or on a website.

leveraging the right tools and resources

To help you help your employees plan for their retirement, there are several resources you can turn to. For starters, existing vendors earn their keep by providing and refreshing informational materials. Other resources, like financial wellness initiatives and expert budgeting guidance, can help employees welcome a conversation about their finances and learn how retirement planning plays a vital role.

Certain tools, like retirement savings calculators, financial planning software and personalized finance programs can make retirement planning engaging, easy and even fun. And features like automatic enrollment for new hires can increase employee contributions and make the decision-making process a lot less complicated.

By encouraging employees to leverage these different tools and resources, you can help them put their best foot forward on the path to financial wellness.

Helping Employees Take Control of Retirement Savings

While the pandemic made most employees more aware of the economy at large, it also motivated many of them to guard against financial uncertainty by taking control of their personal finances. According to the same Empower Institute study as above, 25% of the respondents said saving for retirement is their top financial goal in 2021, with that number jumping to 47% if they’re parents. It’s clear they’re ready to take action right now.

One thing these employees did not want to do away with was a personal touch. Forty-eight percent said they would only trust a human advisor to support their retirement planning, underscoring the importance of maintaining a personalized approach. While many employees are ready to be financially empowered, they might need more one-on-one communications to make decisions about their retirement benefits.

Keeping it Simple and Personal

Above all else, keep things simple, engaging and direct. For employees who are facing financial uncertainty, appealing advice and clear communications can make them feel like it’s the right time for retirement planning, not just a scary to-do.

Employers who can deliver this kind of retirement planning experience are in a position to truly make a difference in their employees’ lives, now and for their future.