When it comes to planning for their retirement, how “in the know” are your employees? According to the American Benefits Council, more than 100 million Americans are contributing a combined $5.7 trillion in assets to 401(k) and other defined contribution plans and 97% of these plans use personalized communication to participants. Are your employees getting the message?

Soon-to-be retirees are a growing workplace population that’s known to sneak beneath the HR radar. As many companies tailor their retirement communications to recent grads and employees new to the world of payroll contributions, this subset is left wondering how to actually utilize their funds. It’s important not only to include them in retirement planning communications, but to craft the kind of messaging that helps them make confident, well-informed decisions about how to retire.

With more generations coexisting in the workplace than ever before, a pointed strategy for retirement benefit communication is an essential way to ensure informative enrollment and exit at every level. From recent grads carrying student loan debt to seasoned professionals about to sign out for good, a comprehensive communication tool provides a certain kind of inclusivity often overlooked by today’s HR teams.

Pre-Retirement Preparation

In March of 2019, Cabot Corporation’s 2018 Retirement Planning Guide won first place in the Pre-Retirement Preparation category. Praised for its exquisite attention to detail, judges said the guide “hit all the right categories.”

Below, we’ve highlighted a few successful ways to communicate retirement planning and its unique relevance to every scenario and stage of life. From enrolling Generation Z, to ensuring soon-to-be retirees had everything they needed as they transitioned into retirement, here’s how to keep everyone covered:

It’s About More Than Just 401(k) Plans

With recent changes in traditional retiree medical plan offerings, enrollment is on the rise (and skyrocketing) for Health Savings Accounts (HSAs) and Employee Assistance Programs. According to the Year-End HSA Market Statistics & Trends Executive Summary, the number of HSA accounts surpassed 25 million in 2018, with account holders contributing almost $33.7 billion (up 22% from the year before).

Since HSAs offer triple tax savings, affordable access to healthcare, permanent ownership and easy employer contributions, it's easy to see why they’re a smart way for employees of all ages to save for the future. And since more benefits mean even more information, it’s more important than ever to cull the facts and figures from separate vendor silos, siphoning and streamlining it for simple consumption.

In an effort to centralize retirement planning and the tools and resources available, Cabot reached out to each of their vendors for precise, up-to-date information to be featured in the Retirement Planning Guide. In the end, this comprehensively informed the content:

- Planning Checklist

- Well-Being Resources

- Cabot 401(k) Plan

- Cash Balance Plan

- Employee Stock Purchase Plan

- Retiree Medical, Dental and Vision

- Waiving or Changing Coverage

- Medicare and Social Security

- Health Savings and Flexible Spending Accounts

- Life and Accident Insurance

- Voluntary Benefits

- Contact Information

Make Searching Easy for Every Employee

When categorizing key information for a retirement planning resource, it’s important to brainstorm from the viewpoint of each and every employee. Depending on their specific user scenario, employees should be able to open the guide and easily locate the information that speaks to them. A Planning Checklist is an important tool for employees to use to personalize their planning journey and ensure they’re taking the right steps on the road to retirement.

Never Underestimate the Importance of Real-Time Feedback

One of the most effective aspects of Retirement Communication is the ability to collaborate with existing employees who are about to retire. Gathering real-time questions and feedback from people who needed guidance informs a realistic picture of communication gaps and roadblocks.

From there, a comprehensive resource can be created to address not just what you think people need to know, but what they actually want to know. The final outcome? A guide made for real people who need real answers.

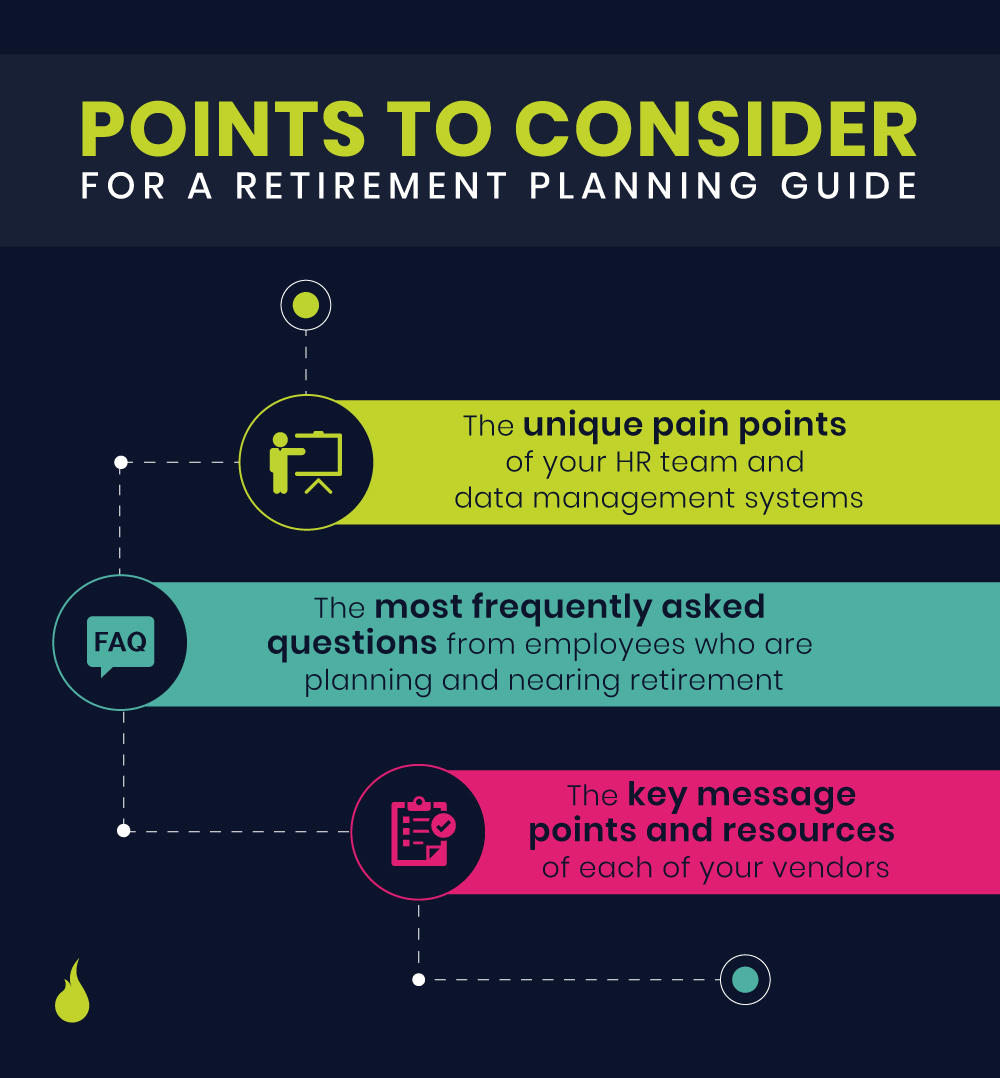

Key Issues to Know Before You Compile

Many lessons were learned in the development of such a complex communication tool. Here are a few of ours, so you can be prepared before you start:

- The unique pain points of your HR team and data management systems

- The most frequently asked questions from employees who are planning and nearing retirement

- The key message points and resources of each of your vendors – for both before and after retirement

If your HR team is “in the know” about retirement planning, make sure it trickles down to your employees. By streamlining vendor data and getting real-time feedback from your employees, you can compile the kind of communication tool(s) that address every issue at every stage of life, ensuring an enjoyable retirement planning experience for everyone involved.